Greetings from Team Carnelian!

“No one ever made a decision because of a number. They need a story.” – Daniel Kahneman

Stories can persuade and connect people allowing one to store and understand complex information. MRI scans have shown that neural circuits which process emotion, light up when one is listening to a story. It is this emotional aspect of storytelling that can cause a narrative to catch people’s attention and lead them to act.

Markets, a collection of human emotions, also create and act based on stories and narratives. Often seen, stories get built based on what confirms common belief, not challenging the established norm even if it is factually not supporting.

Let’s visit this following short humorous story which reminds us on how narratives and stories work.

The indigenous people story

At the brink of winter, the indigenous people asked their “new Chief”, if the upcoming winter would be harsh or mild. The new chief, unversed with old methods was clueless; nevertheless, he predicted a harsh winter “to be on the safe side” and asked the members to start collecting wood in preparation.

To affirm his prediction, he connected with the national weather service for their forecast. The meteorologist too predicted an extraordinarily harsh winter. The chief satisfied, returns and orders his men to collect every scrap of wood available.

Few weeks down the line, he re-connected with the meteorologists re-confirming their weather forecast. The weathermen, confident than ever, replies “absolutely! it’s going to be one of the harshest winters ever”. “How can you be so sure?” asked the Chief. The weatherman replied, “The indigenous people who have been historically correct are collecting wood like crazy.”

This is how a narrative gets built and once built (like the confidence on indigenous people ability to predict weather), reaction to it is manifold – more so in the present age of social media where it gets blown out of proportion rapidly. Doesn’t it sound familiar to how narratives get built in markets?

James Montier in The Little Book of Behavioral Investing has also highlighted that X-system, which is essentially the emotional approach to decision making is the default option for processing information. Rather than relying on the C-system, which is the more logical way of processing information, humans use X-system because it is automatic and effortless. The judgements made by the X-system are generally based on aspects such as similarity, familiarity, and proximity (in time).

In essence, the easier it is for people to picture something, the more they believe in it. Humans rely on mental shortcuts to deal with large amounts of information and prefer to give answers that are approximate, rather than precise.

Stock market and narratives

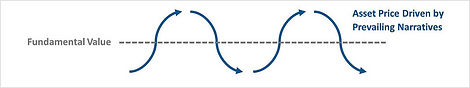

Narratives are not new to the markets – as long as human beings are involved, the same will continue. Narratives could either be pertaining to the hindsight (historically it has worked and therefore will work this time as well or vice versa) or could be forward looking. As a narrative gathers steam, it can go far and wide, reaching a level of contagion. At this point, the intrinsic values and market prices diverge, thereby making an investment opportunity either too lucrative or too expensive. Hence, avoiding this becomes very important.

In markets, real money is made when you look “Beyond Narratives”

A major source of alpha is looking “Beyond narratives”. This applies to both hindsight narrative and forward looking narrative. Big opportunities to capture re-rating or de-rating happens only when you play “Beyond narratives”. We, at Carnelian, constantly try to evaluate things beyond narratives before making an opinion.

How to look beyond narratives:

Looking beyond narratives requires an unemotional approach to looking at data/event, connecting dots, steadfast focus on risk reward and guts to take a contrarian call.

1. Unemotional focus on looking at data/events:

Be it evaluating a company or industry, markets usually get colored by the common narrative. Any data/event is usually rejected at first as an exception and ignored. However, when one sees a change beyond common narratives and is able to corroborate it with “a trend”, real opportunities arise.

2. Connecting the dots

One needs to connect the dots as clear data points may not be visible. To play beyond narratives, one must connect the dots and rely on information that is not otherwise available. At times, a piece of random information can give such valuable inputs, which a series of data may not be able to! Post Covid, the government’s focus and willingness to act quickly on non-trade tariff barriers (which never existed before in that size) gave us huge confidence on its resolve to make it happen.

3. Steadfast focus on risk reward:

Playing beyond narratives must always be seen in context of the favorability of risk-reward. Usually, when you are playing beyond common beliefs, risk reward is in your favor. If it’s not, then there is no merit in playing beyond narratives. If one were to go wrong, one would lose much money. Therefore, one should establish check points at which one will change their view. Discipline and focus in most important.

4. Guts to handle public perception

This is extremely important when one is managing third party money. At times, perception plays a more important role than the details/logic of the decision. We have seen many FMs go through this challenge, even risking their careers. It is this situation that plays in the minds of most money managers. Risk-reward of taking such aggressive calls is less in favor of money managers’ careers. Hence, most managers end up falling within the narrative. Therefore, one needs to have a strong gut to play “Beyond Narratives”. Only asset management companies with a leadership structure that allows to do this, can play Beyond Narratives. These are very far and few.

Beyond Narrative mindset as Risk Mitigation

It’s also true that when one is playing narratives, one is going with the market momentum – just like everyone. Playing with a “Beyond Narratives” mindset is also helpful in assessing risk ahead of the curve; to see things that others miss. For example, in mid of 2021, everyone fell prey to the ‘New Tech’ company momentum. Even though many didn’t understand the business models and how to value these companies, investors invested a lot of money in those names, eventually losing capital. We believed otherwise and wrote a piece called “FAD-FOMO-FADE”, highlighting our views on this. We never invested at that time as we felt a lot of euphoria was going on and that this narrative would fall apart in fullness of time.

Let’s understand this with some cases of industries and companies.

Back in July/August 2020, when we were evaluating opportunities from the lens that ‘every crisis brings an opportunity’, two major thoughts crossed our mind based on an initial hypothesis.

1) Manufacturing opportunity

Common Narrative: ‘Manufacturing in India cannot do well. China is the big daddy. Bangladesh has beaten us in garments. We have no shot at manufacturing’

Our Process: We spoke to over 50 companies across the country and across sectors, and global consultants. We collected data on India’s improved competitiveness, India’s strength and government policy changes post Covid / post Doklam. Some companies even told us that products in India are cheaper when compared to China. Some told us that customers who took 5 years to give approvals were now doing it in 6 months.

Our Findings:

- India’s labour cost is 1/3rd of the labour cost in China.

- Power cost in India is almost same as in China

- Government is aggressively pushing for import substitution and China +1 is real.

We concluded that companies/industries with proven capabilities and small batch production business (not bulk where China gets benefit of scale) will do well. We looked at specialty chemicals, industrial capex and capital goods, garments, auto ancillaries, EMS etc.

Outcome: The stocks have delivered almost 5-7 times returns in last 4 years. Most people are now launching manufacturing funds.

2) Information Technology (IT) sector

Common Narrative: ‘Technology is a low growth sector. Covid crisis, just like GFC of 2008, will lead to slow down in IT sector. Real opportunity is in product and platform companies in US.’

Our Process: In our interactions with companies & consultants, we realized that post COVID, ways of working of every company was changing. WFH was a new reality, and each company was forced to spend money on an urgent basis to get ready to changing need.

Our Findings: Most people agreed with us but were shy of giving a public guidance on high growth as no one wanted to go wrong. They were preparing but not communicating. We concluded that this is great opportunity. Our common sense told us at 15-18 times PE with 4-5% dividend yield, risk reward was extremely favorable even if we were to go wrong. We said that IT is the new FMCG

Outcome: Most stocks have delivered almost 5-7 times return in last 4 years.

3) Power and power ancillaries

Common Narrative: Power and related ancillary stocks were looked at with hindsight bias of them having debt related issues etc. The focus is towards renewables.

Our Process: We evaluated capacity addition data, noting that in thermal power, significant capacities had not been added in the last 5 years. We also observed that states where historically power cuts were uncommon started witnessing frequent power cuts, indicating a rising shortage of power.

Our Findings: Demand in the power sector was steadily growing, there was further uptick in demand on account of manufacturing picking up in the country. We also observed that renewable sources such as solar would be insufficient to meet this demand due to its inherent limitations. For e.g. solar power is only available during peak daylight hours and cannot contribute during evenings / nights. We concluded that large capex would be required in the power sector to meet the increasing demand and to make up for lower capex in previous years.

Outcome: Power and related stocks have gone up nearly 3 times over the last 2 years.

4) PSU Banks

Common Narrative: Around Covid, PSU Banks were judged to be wealth destroyers, considering their NPA issues. It was a no go for most investors.

Our Process: We evaluated the asset quality of PSU Banks and witnessed that this was improving with every passing quarter. There was new leadership at the helm of many of these banks who were driving change.

Our Findings: We concluded that the 3 major changes – Governance, Leadership (new CEO’s) and a strong banking cycle could be a catalyst for PSU Banks. Since Historical NPA’s were well provided for and valuations were at less than 1.0x P/B, we saw risk-reward to be extremely favourable, especially in context of the improving asset quality.

Outcome: PSU Banks have gone up 3 – 4 times over the past 3 years.

5) Pharma sector

Common Narrative: Pharma companies exposed to US business are perennial capital guzzlers having issues related to pricing and FDA, therefore only domestic focussed franchises will continue to do good.

Our Process: In our experience of tracking pharma companies, we did acknowledge of the problems in the US markets but were also cognizant of the fact that many companies were also at the same time building presence in niche speciality segments in the US markets.

Our Findings: We were following the consolidation trend in pharma distributors, pharmacies, PBMs and healthcare insurance in US markets for the past ten years, leading to intense pricing pressure for Indian generic players which have >40% market share in US generic market. However, after years of this consolidation and price squeeze, lead to drug shortages during and post covid. US FDA cleared all the pending plant approvals and started giving faster approvals to deal with shortages which was the trigger point for us. In 2022, the earnings and valuation multiples of US focussed companies were at the rock bottom with extremely attractive risk reward. We looked beyond the going narrative and focussed on business and valuation cycles to invest.

Outcomes: Large Cap Pharma stocks have more than doubled in last 3 years.

Let’s look at the cases of a few companies:

1) ICICI Bank

Common Narrative: Prior to 2019, Poor Governance, Bad Asset Quality & Poor growth were the narratives. Stock was trading around 1 x P/B

Our Findings: All of it was true but we noticed that in May 2019, it changed in a big way under new leadership. Culture and strategy of the bank changed significantly. The bank’s employees’ motivation and morale changed significantly. Credit provisioning cycle was mostly behind. Risk reward at 1 time book was huge. Bank ROE could go to 15-16% in a few years.

Outcome: Stock is up 5x in 5 years. Today it is trading at almost 2.6x P/B.

2) AB Capital

Common Narrative: Poor Growth, Wholesale book, no differentiation in business model. Stock trading at 1 times P/B.

Our Findings: In NBFC business, liability side is very important. AB cap with AAA borrowing, and new CEO – Vishakha with huge experience of handling scale and risk, re-oriented business in retail with granular risk management, giving us confidence to buy this.

Outcome: Stock is 2.4x in less than 2 years.

3) HDFC Bank

Common Narrative: Great company, great track record. Historically traded at 4.0x P/B

Our Findings: We believed that while it’s a great company, it may not be a great stock to invest in. Stock got re-rated in a period 2009-18 significantly as HDFC bank did great job in risk management. Other Private / PSU banks were un-investable for many investors in that period, which led to huge flows to this stock. As others became investable, money flow moved out and lead to derating. This was a gutsy beyond narrative call.

Outcome: Stock trading 2.5x P/B and has given almost flat returns during 2021-2024.

At Carnelian, we have imbibed a culture where we focus on the core principles of investing and on data points rather than market narratives and stories. Our detailed work and discussions across sectors and focus on linking narratives to the on-ground realities help in identifying the reality vs. the narrative.

Our culture requires us to work in detail on each company, focusing on its fundamentals, opportunity size, risks, valuations, etc. while evaluating the company. Our Magic basket requires us to look at change, be it – change in CEO/Promoters, change in industry structure, change in business strategy etc. without having any regards to historical narratives that it would have had. Similarly, for upcoming opportunities, our focus is to not get carried away only by the opportunity size narratives, but having adequate focus on different risks as well. Our CLEAR and Connect frameworks help us in co-relating the management stories with the actual on-ground realities. These assist us in limiting biases.

We are not saying that we are not prone to biases/narratives. However, our internal processes and our philosophy enables us to limit the risks arising out of narratives. As with most biases, having a process and sticking to the process helps in avoiding it.