The most common question we get from investors and potential investors specially at the current juncture is “is it the best time to invest in the market?” - this is where the idea of this note was born. When we studied the psychology behind this question, we found that most people are worried about the risk of stocks/markets falling after they have invested. It is a feeling of rejection/being foolish, which one experiences. But we can say with certainty, there is no investor howsoever smart, who has not gone through this feeling. This is the wrong risk to manage.

We have outlined our views in many of our previous letter (Mega Trends, What next?, Learn from history, Digital revolution, Lollapalooza effect and many more) about the super cycle for Indian equities over the next 5-10 years. However, that does not take away the need for understanding risk. Decision making becomes slightly easier and better when we try to understand risk and controllability of those risks.

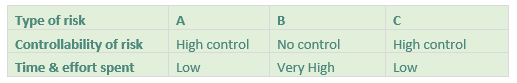

At Carnelian, we classify risk into three simple buckets:

Type A - Risk of permanent loss of capital or Total loss risk: risk of losing ~70-100% of capital

Type B - Volatility Risk (MTM loss Risk): risk of an investment temporarily going below the investment price

Type C - Underperformance risk/Opportunity loss risk: risk of investing into sub- optimal stocks/sectors/asset class due to various biases and lack of knowledge thereby missing superior returns

Another dimension to explore is one’s ability to control or manage risk. We can address/control some amount of risk through our efforts/study/knowledge but can never control some risks through any amount of effort /work, thereby making it futile to spend a lot of time on them.

We believe Type A risk and Type C risk fall under the purview of controllable and manageable risks but not Type B. The reason for the same can be well understood from the sources it emanates from, which we shall discuss more in detail.

What is most fascinating is that there is an inverse relationship in the time spent and controllability of the risk, whereas it should be the other way around. Most investors are constantly playing the game of predicting and managing volatility. You will notice that most of the causes of Type A risk are something we can avoid with in-depth work/detailing and at the same time most of the causes of Type B risk are beyond our control and influence. Funnily enough, most people end up spending a lot of time on things which are beyond control i.e., volatility risk and least on what’s within control i.e., permanent loss risk or opportunity loss risk.

Common approach of time & effort spent and controllability of risk

Type A - Permanent Loss Risk: highly controllable

The two main sources of this risk are inferior quality of management and business model disruption, which results into a permanent loss of capital. Historically we have seen several such examples (Enron, Satyam, ADAG group, Manpasand, Jet, Dewan Housing, Yes bank etc..) where serious amount of wealth destruction has happened either due to fraud, poor capital allocation, excessive leverage or a combination of many such factors. Likewise, we have seen how many blue-chip companies of their time have destroyed value due to one or the other business disruption risk (Kodak, Nokia, Blackberry, MTNL, etc..). It is easier to avoid this risk largely by sticking to the right investment processes and in-depth research around the business and quality of management.

At Carnelian, we spend a lot of time managing this risk. We believe there are lots of signs of poor quality of management which manifest in several ways either in the balance sheet, accounting policies, dealings with channel/customers etc.

Our CLEAR Framework (focusing on Forensics) which comprises of detailed cash flow analysis, capital allocation, liability analysis – true vs reported debt, earnings analysis, asset quality and related party transactions and governance checks and our PIU framework which comprises of scoring business & management on many parameters including business disruption risk, protects us from getting into a permanent loss risk.

We have a clear NO GO when we find the business bears disruption risk even if the rest of the parameters are fine. There have been umpteen number of instances where we have rejected investment opportunities where we see even a small chance of permanent loss of capital during our investment horizon.

Interestingly, there is a co-relation – companies which don’t carry a permanent loss risk (using these filters) are also the ones who deliver superior returns than the market (more on this will be covered in future updates, sometime later).

Type B - Volatility Risk: highly uncontrollable but get maximum time and attention!!!!!

The source of this risk comes from many factors (macro factors like monetary policies, political matters, geo political risk and many more) which are totally unpredictable. e.g. when the Indian economy in early 2020 was on an uptick and recovery phase, the Pandemic hit and led to a significant fall in the stock prices. Could anyone have predicted that? Yet we all have seen that strong businesses with sound managements, which also fell significantly, have come back with a lot more vigour. This has happened many times and will continue to happen. This risk will always come suddenly and from unknown or uncontrollable factors.

Why do people spend significant time, focus & energy in manging volatility? Maybe it’s an addiction, maybe it gives them a high, it gives them an illusion of control, it ignites “bias to action” and most importantly may be sometimes, it is instantly gratifying. It is the same reason investors worldwide tend to spend maximum time predicting and managing something which is beyond their control and end up messing up with their good investments. No wonder according to a study done by Fidelity, the dead or forgetful investor performed best as they are in-different to any kind of intermittent volatility and ain’t able to react to any volatility as they are either dead or don’t know about volatility.

Trying to time the market, panic-selling or panic buying (buying due to FOMO) will almost never beat the returns of long-held investments. It’s a fool’s errand to try to anticipate the various booms and crashes that the stock market will inevitably go through. Instead focus on the long term. Time in the market is important than timing the market. The cost of waiting for the perfect time to invest is high.

“Far more money has been lost by investors trying to anticipate corrections, than lost in the corrections themselves.” – Peter Lynch

As can be seen from table below all superior returns are accompanied by periods of extreme volatility in the long run; but the key thing to ask is does it matter or can you manage that? Most investor who trade in their core holding eventually end up losing from the holding or most investors who are trying to buy a stock end up missing the buying. Of course, we are not making a point that you should buy stock at any price but when all things seem to be in place (keeping in mind the broader India super cycle), timing isn’t helpful. Also, if you are a short-term investor or a leveraged investor, you MUST worry about and manage this risk. We ain’t.

Many stocks which have delivered superior returns over a long period, too have corrected significantly. It means volatility risk does exist even in high quality companies, but it’s impossible to manage and time it consistently over a long period of time. On a lighter note, it can be said that no matter how much diligence you did before your marriage in finding your life partner (biggest investment one makes), one has to live with volatility which comes along with it. 😊

Even the index has returned 400 times in last 40 years irrespective of all scams, crisis, wars, economical & political issues; it has seen multiple drawdowns of greater than 25-30% but have delivered returns.

The longer you can extend your time horizon, the less competitive the game becomes, because most of the world is engaged over a very short time frame…William Browne.

There is a great opportunity in front of us to shift focus, time and energy from Type B to largely Type A and C; it requires a lot of emotional training, discipline and willingness to bring this shift. It is no different from a smoker willing to quit his smoking habit; at the very core we are talking about challenging and transforming our deep-rooted habits and manage emotions well.

At Carnelian, we do very little to manage Type B risk and whenever we have tried, we have failed.

We believe staying focused and having a long-term clear picture will deliver desired return irrespective of market volatility. We will continue to be guided by our frameworks (CLEAR & PIU) and investment process to avoid any volatility led reactions. We are seeing positive outcomes in lot of our investments across insurance, pharma, consumer and other sectors.

Type C - Opportunity Loss Risk

“After nearly making a terrible mistake not buying See's, we've made this mistake many times. We are apparently slow learners. These opportunity costs don't show up on financial statements, but have cost us many billions”. - Charlie Munger

Most of us never consider an opportunity loss as a loss since the same never crystalises in the form of an actual loss. May be the same psychological factors are at play when lot of opportunities we missed in every aspect of our life either went unnoticed or we do not feel the magnitude of missed opportunities. Just to extend this argument further, the opportunity cost of not exercising on a daily basis is huge in the long run and we understand the implications only when life finally throws evidences at us late in life, similarly the opportunity cost of not investing in knowledge is huge in the long run, in the absence of any reference we love to be in status quo, in denial or in our comfort zone.

Most of the times we tend to have a reference which is most convenient, familiar and within our comfort zone. In the context of investing also many a times we are completely ignorant about opportunities market throws at us but we end up making less efficient choices due to our biases (familiarity bias, endowment bias, confirmation bias, choice paralysis, style bias and many more).

Many investors constantly remain focused on a limited opportunity set and work with huge biases. Investing is about future. While some things never change, many things will never be the same. How to remain stuck to things that don’t change and upgrade/learn/adapt to irreversible change is where the pot of gold lies. This is not easy to keep, still most investors spend much less time on this than it deserves.

The table below highlights how significant a difference can be over a 10 -20-year time frame – over a period of 20 years, the difference between a 10% & 15% CAGR is ~1000% and the same is ~8000% between a 10% & 25% CAGR.

One very interesting fact is, there are 228 stocks (Market cap >1000 Crore) which have given >20% CAGR returns and within that 151 stocks given >25% CAGR returns in the last 20 years!!!!!!!! Many of us missed a lot of opportunities to create significant returns as we are stuck with less efficient choices. Many of us have unconsciously remained within our circle of comfort and of-course misled by lot of our own hidden biases.

Some of the key examples which come to our mind are

1) Warren Buffet chose not to participate in technology stocks for 15-20 years. He clearly cited that it is something beyond his circle of competence and eventually he ended up buying Apple at a market cap of over USD 1tn and missed significant opportunity initially. (despite Bill Gates being a personal friend!). (Disclaimer: we respect him a lot and have learnt a lot from him)

2) Many investors we know have never bought stocks of the HDFC Group because they were expensive, thereby missing this great wealth creation cycle. Of course, good things are expensive. Over obsession with PE/valuation is the single biggest reason that lot of investors missed significant opportunity of wealth creation. A growth, quality & durability adjusted parameter is a better matrix to evaluate.

3) Sometimes sticking to “value” as a lone parameter ignoring everything else can cause huge underperformance for a significant period. Lot of PSU stocks give huge value illusion but have proved to be drag in the long run.

4) Anchoring bias is one of the reasons for many unwanted stocks in the portfolio and missed opportunity. “Cannot buy as price has gone up from my reference point and cannot sell as prices have come down from my cost” is a very common reason for significant opportunity loss. We have seen investors missing massive opportunity but unable to book losses and switch from old holdings, thereby creating opportunity cost. But the pain felt for this is very little.

5) Lot of us are so influenced by our biases that we do not even entertain evidence of change or transformation in a particular industry or stock and miss upside by big margin. How many of us appreciate new platform-based business models? or new “Shifts” taking place in economy.

At a broad level how one expands his circle of competence, deal with circle of comfort and manages behavioural biases determines how effectively one will manage Type A, B or C risk. Market will constantly test emotional durability, patience and the ability to deal with volatility; one who responds to it with most appropriate behaviour and sound processes will win eventually. Given below is an illustrative diagram of behavioural biases which significantly impact Type A, B and C risk. We will cover various biases and its impact in our subsequent letters sometime later.

Summary:

We at Carnelian believe that it is beyond our capability to predict volatility. Our constant endeavour is to focus on avoiding Type A and Type C risk. We have proprietary frameworks (CLEAR and PIU) which help us in avoiding Type A risk to a great extent. Constant agility, being watchful of current trends help us in filtering opportunities to avoid Type C risk.

Eight months ago (October 2020) post COVID, we launched a dedicated strategy called the Carnelian “SHIFT” Strategy noticing a decadal shift happening in manufacturing and technology. We find most people are still looking at it with the lenses of past where India has been poor, ignoring the changes taking place.

Same thing we believe, if one continues to look at the overall India story with same lenses of the past, it will be doing huge injustice and carrying Type C risk. “India is in one of its best super cycles” and a huge multiplier effect to Indian economy is likely to play out with many structural changes.

While we write this, we don’t claim to be perfect and away from many of the biases and risks we are talking. Being aware itself is very important and pushes us to constantly learn, unlearn and adapt. I am sure we will make our own set of mistakes but we do believe that a process led approach will come out eventual winner in long run and we will continue to invest significant time and energy to refine it.

Market Outlook

There are lot of Type B risks knocking at our door, like always,

1. Fed raising interest & unwinding risk,

2. Third wave (Corona),

3. Rising inflation

4. Overexuberance and rising retail participation, penny stocks performance

These risks will bring significant volatility as and when they play out in the short to medium term; we don’t know that. In our view, the best way to deal with the volatility (which may or may not play out) is to focus on long term and shift attention to Type A & C risk. Great businesses have always given superior returns in long run as they have adaptability and agility to respond to all such situations. We believe India is a great story and can surprise positively in the next 5 years. Smart money will continue to chase good businesses and good management.

You have to decide which Type of risk you want to focus on – A, C or B

You have to decide – who is stealing your returns, you or markets?

We have put our own money on India’s super cycle. You can consider us biased or knowledgeable, only time will tell!

Comments